FinCEN Engages in Outreach as CTA Deadline Looms

November 19, 2024 | Stella Lellos | Lindsay M. Brocki | |WHAT: A filing with FinCEN disclosing information about certain entities and owners.

WHO: Nonexempt entities formed or registered to do business by filing a document with the state and the beneficial owners of such entities.

WHEN: Companies formed prior to January 1, 2024, must file by January 1, 2025.

WHERE: FinCEN’s Beneficial Owner e-filing system here.

WHY: To combat financial crimes, such as money laundering, terrorism, human and drug trafficking and tax evasion.

By January 1, 2025, millions of existing businesses must have filed certain information with the Financial Crimes Enforcement Network (FinCEN) to remain in compliance with the Corporate Transparency Act (CTA). As this deadline approaches, concern is growing among lawmakers. During a House Financial Services Committee hearing, committee members highlighted that many businesses have “no idea” they are subject to the CTA’s reporting requirements.

FinCEN has estimated that over 30 million businesses will be subject to reporting requirements under the CTA. In an effort to spread awareness, FinCEN has hosted outreach events across the country to educate businesses of their obligations under the law. Despite these efforts, lawmakers emphasized that less than 3 million businesses had filed their requisite reports as of this summer. This “low percentage” of compliant businesses raised committee members’ eyebrows, particularly given the high fines for noncompliance — $500 for each day a business remains in violation.

While Treasury Secretary Janet Yellen assured committee members that FinCEN is “engaging in a very extensive outreach and education effort” to inform businesses about the CTA, experts maintain that general awareness of the law is lacking.

A CTA Refresher

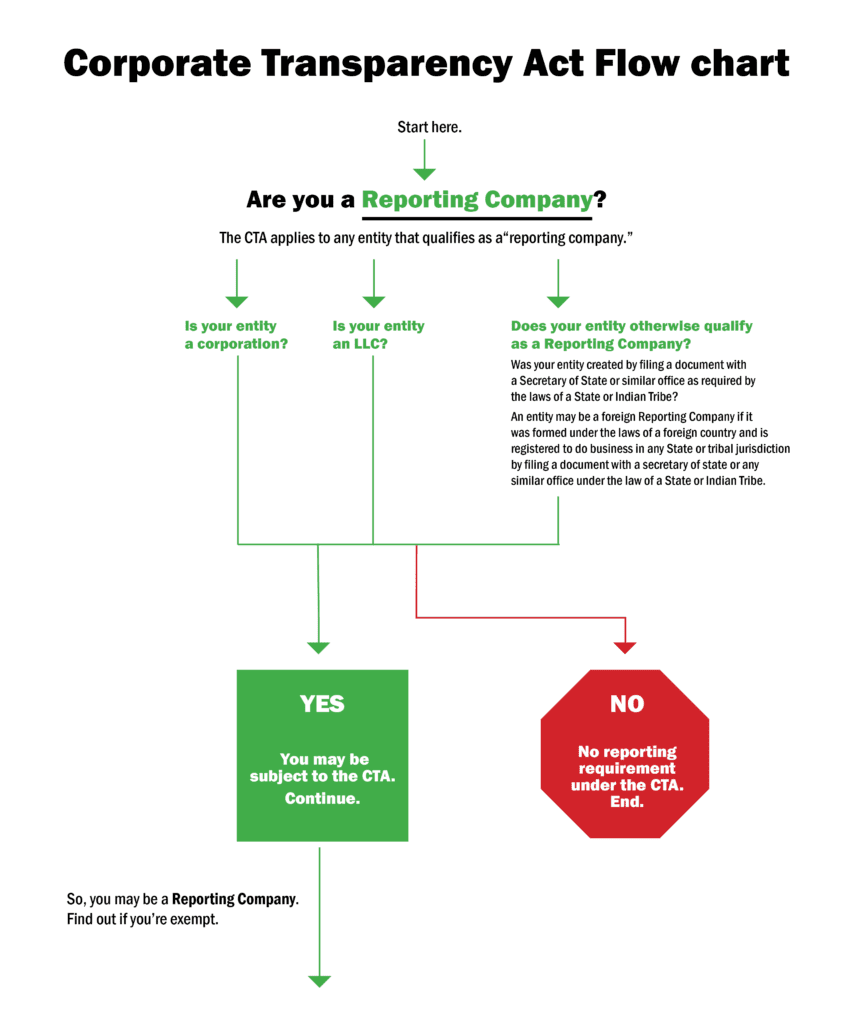

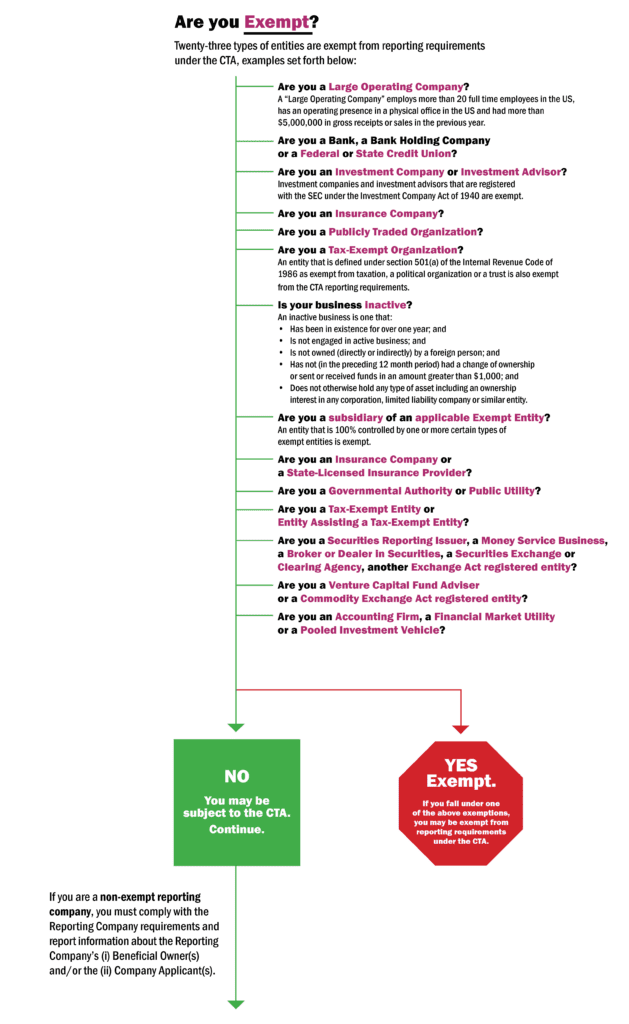

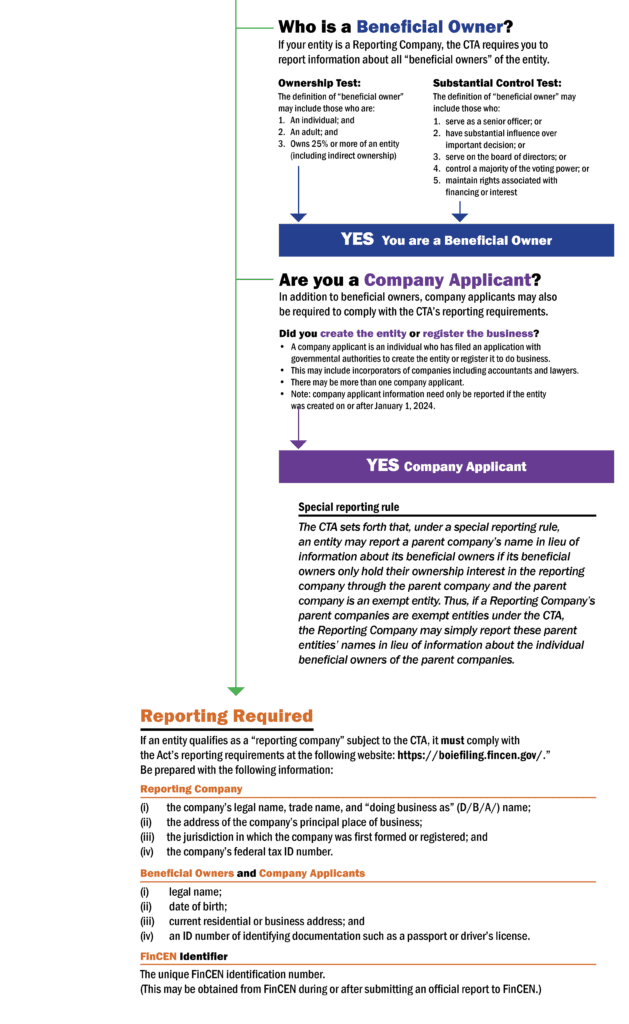

The CTA is a federal law that went into effect on January 1, 2024. Under the CTA, any entity (e.g., a limited liability company, a corporation, or a limited partnership) that is created or registered by filing a document with a secretary of state or similar office will qualify as a “Reporting Company”. All Reporting Companies that are not subject to one of the CTA’s 23 exemptions will be required to report certain information in a filing to FinCEN about the Reporting Company. Further, individuals with ownership interest in a non-exempt Reporting Company may be required to file a “Beneficial Owner” report to FinCEN. A more exhaustive CTA analysis may be found on the below flow chart.

Deadlines

Any Reporting Company formed after January 1, 2024, must file a FinCEN report within 90 days of formation. All other Reporting Companies—those formed before January 1, 2024—must file with FinCEN by January 1, 2025.

For more information on the CTA, click here.

October 2024 FinCEN Updates

Last month, FinCEN issued explanatory updates to its Beneficial Ownership Information Frequently Asked Questions website. Among these recent clarifications, FinCEN provided additional color to the CTA’s subsidiary exemption. Under the Act, a Reporting Company may be considered exempt if it is a wholly owned subsidiary of an entity that falls under certain other Reporting Company exemptions. FinCEN noted that a Reporting Company may properly fall under the subsidiary exemption if it is controlled or wholly owned by more than one exempt entity, even if these exempt parent entities are not affiliated with one another, so long as each parent entity is itself exempt from the CTA reporting obligations. However, a Reporting Company is not exempt under the subsidiary exemption if any of its interests are controlled by a non-exempt entity or an individual.

Ongoing Litigation

Parties across the United States have raised constitutional challenges to the CTA, notably in the Northern District of Alabama and the District of Oregon. In November 2022, the National Small Business Association initiated a lawsuit in Alabama against the U.S. Department of the Treasury, contending that the CTA overstepped congressional authority under the Commerce Clause. The court sided with the plaintiffs, prompting the government to appeal the decision to the Eleventh Circuit. Oral arguments were heard on September 27, 2024, and the Eleventh Circuit is anticipated to remand the case back to the lower court. Meanwhile, in the District of Oregon, plaintiffs sought a preliminary injunction to halt the enforcement of the CTA. However, the court ruled that plaintiffs’ constitutional arguments were unlikely to prevail and subsequently denied the motion for an injunction — meaning the court is unlikely to overturn the law.

Consult with an Attorney

It is important to consult with an attorney regarding the CTA to ensure compliance and safeguard against potential regulatory pitfalls. A qualified attorney can provide expert guidance on how the CTA may impact your organization, help navigate the complexities of compliance and, if applicable, advise on the steps to file a report with FinCEN.